Comprehending the Different Types of Finances Readily Available for Every Need

Recognizing the various sorts of finances is important for anybody navigating monetary choices. Each finance kind serves an one-of-a-kind objective and comes with its very own set of problems and terms. Individual lendings give adaptability, while home mortgages help with own a home. Car and student fundings deal with specific purchases and investments. Options like cash advance fundings can lead to economic pitfalls if not managed wisely. The nuances of these car loans necessitate a closer assessment.

Individual Finances: Flexibility for Your Economic Requirements

Just how can individual financings work as a functional economic tool? Personal finances supply people with an adaptable means to address various financial requirements. Unlike certain loans such as vehicle or mortgage, individual car loans can be used for a vast array of objectives, including financial debt loan consolidation, medical costs, or moneying a significant purchase. This versatility makes them specifically appealing.

Typically unsafe, personal financings do not call for collateral, making them obtainable to many borrowers. Lenders analyze creditworthiness with credit history and income, enabling people with diverse economic backgrounds to qualify.

Furthermore, individual financings commonly include fixed rate of interest and predictable regular monthly repayments, assisting customers in budgeting properly. With repayment terms varying from a few months to numerous years, these finances use choices that can line up with individual economic scenarios. Personal loans stand out as a functional choice for those looking for financial versatility and prompt assistance.

Home mortgages: Financing Your Desire Home

Home mortgages serve as a vital monetary instrument for people desiring buy their dream homes. These finances allow buyers to finance a considerable section of the home's cost, permitting them to spread payments over an extensive period, commonly 15 to 30 years. Home loans come in numerous types, consisting of adjustable-rate and fixed-rate alternatives, accommodating different economic situations and choices.

Fixed-rate home loans supply security with regular monthly payments, while variable-rate mortgages may give lower preliminary prices but carry the risk of future variations. Furthermore, government-backed finances, such as FHA and VA financings, help those with reduced credit history or military solution backgrounds in securing financing.

Prospective property owners must completely evaluate their financial situation, taking into consideration aspects like down settlements, rate of interest, and lending terms, to make informed choices (Cash Loans). Inevitably, a mortgage can transform the desire for homeownership right into fact, making it an essential factor to consider for numerous individuals and family members

Auto Finances: Driving Your Dreams

For lots of people, possessing an automobile is as crucial as possessing a home. Vehicle loans act as an important monetary source for those looking to buy an auto, whether it be for travelling, household demands, or personal enjoyment. Normally provided by financial institutions, lending institution, and car dealerships, these lendings permit borrowers to finance their vehicle over a set term, generally varying from three to seven years.

Passion rates might differ based upon creditworthiness, finance term, and the kind of car being funded. Consumers can pick in between brand-new and pre-owned cars and truck loans, each featuring distinct advantages and considerations. It is essential for prospective customers to assess their budget plan, regular monthly payments, and overall car loan prices before devoting. Eventually, car finances can assist people drive their dreams, making automobile possession obtainable and convenient for numerous.

Pupil Lendings: Buying Your Education and learning

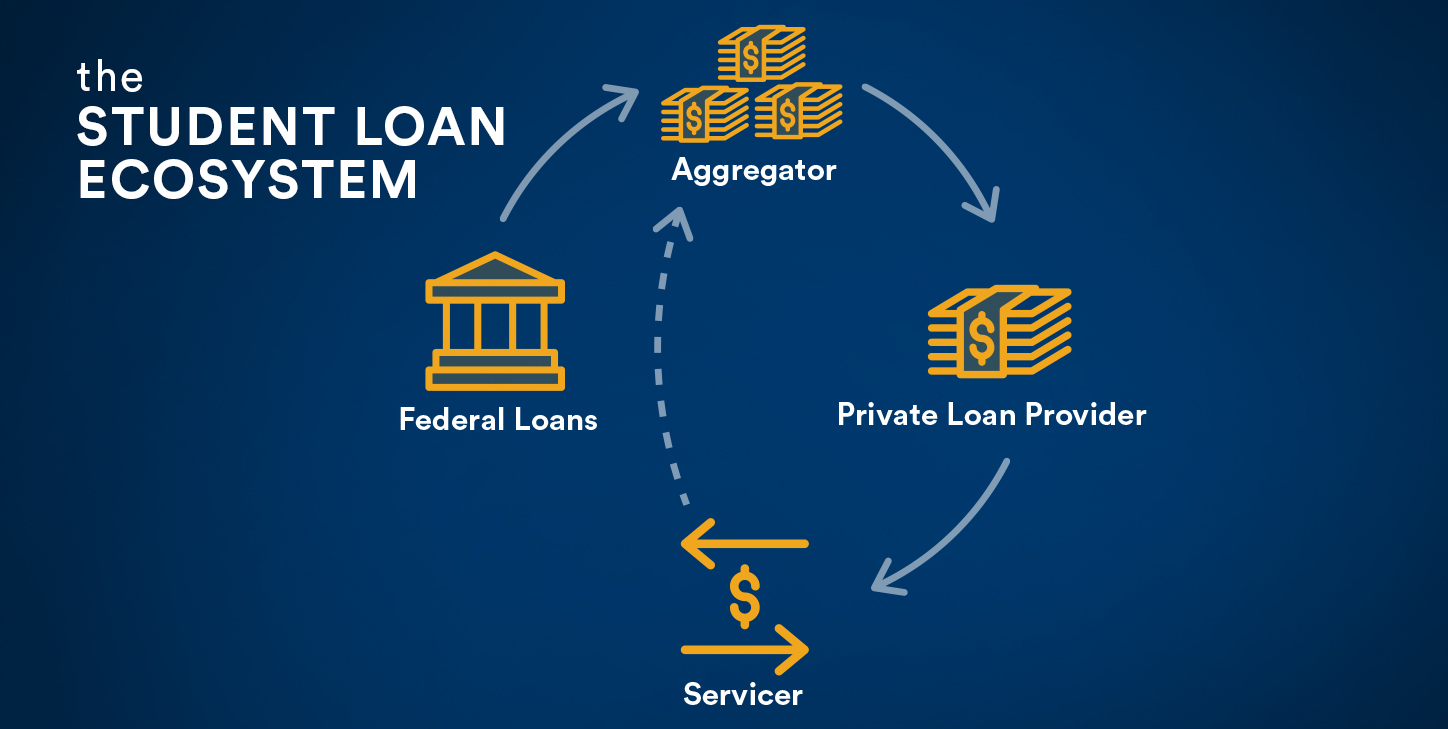

Trainee financings are a crucial financial device for countless people looking for to further their education and learning and improve occupation chances. These finances provide the needed funding for tuition, charges, and living expenditures, enabling students to focus on their studies without the immediate problem of economic pressure. Offered in various weblink forms, such as government and exclusive car loans, they deal with monetary situations and various requirements.

Federal pupil financings normally provide lower interest prices and flexible payment choices, making them a preferred selection. Alternatively, personal lendings may have differing conditions and terms, often calling for a debt check and a co-signer. It is vital for debtors to comprehend the ramifications of student debt, including repayment timelines and rate of interest, to prevent economic risks post-graduation. Investing in education and learning through student car loans can produce substantial long-lasting advantages, leading the way for improved task leads and greater making possible in the competitive task market.

Cash Advance Loans: Quick Cash Solutions

Exactly how can people quickly accessibility money in times of economic requirement? Cash advance function as a fast option for those dealing with unanticipated expenditures. These temporary financings, usually for tiny quantities, are made to link the void up until the borrower's following income. Individuals can get cash advance online or in-store, typically receiving authorization within mins.

The application procedure is straightforward, requiring very little documentation and no extensive credit checks, making them available to a vast array of borrowers. Payday finances come with high-interest prices and fees, which can lead to a cycle of financial obligation if not taken care of appropriately. Borrowers need to be cautious and totally comprehend the terms before continuing. While payday advance loan can give prompt relief, they must be thought about a last hope due to their prospective financial ramifications. Ultimately, people ought to consider the advantages and dangers carefully when going with this quick money solution.

Often Asked Inquiries

What Variables Affect My Finance Qualification and Rates Of Interest?

Car loan eligibility and passion prices are affected by aspects such as credit report, revenue degree, debt-to-income proportion, work background, finance amount, and the particular lending institution's standards. These components figure out the threat viewed by loan providers.

Just How Can I Enhance My Credit Report Before Requesting a Loan?

To improve credit report, people should pay costs promptly, decrease arrearages, stay clear of new credit history inquiries, and routinely examine credit scores records for errors. Regular positive economic habits can bring about enhanced credit reliability before lending applications.

What Records Are Needed When Making An Application For a Loan?

When using for a funding, individuals typically need to supply identification, evidence of earnings, credit report, employment confirmation, and details of existing debts. Extra files might vary depending on the lending institution and loan kind.

Can I Re-finance My Finance Later for Better Terms?

Yes, refinancing a car loan for much better terms is possible. Borrowers commonly seek this alternative to minimize passion rates or adjust payment timetables, possibly leading to considerable financial savings and boosted monetary versatility with time.

What Should I Do if I Can't Repay My Lending on Time?

If unable to pay off a wikipedia reference finance promptly, the person needs to communicate with the lender, check out feasible repayment options, take into consideration funding restructuring, or look for economic therapy to stay clear of additional issues and prospective damage to debt.

Personal car loans provide individuals with an adaptable methods to address various monetary demands. Unlike details finances such as automobile or home car loans, personal car loans can be made use of for a vast range of objectives, including debt loan consolidation, clinical expenditures, or funding a significant acquisition. With repayment terms varying from a few months to a number of years, these loans offer choices that can align with specific economic circumstances - Fast Cash. Pupil lendings are an important top article economic tool for plenty of people seeking to enhance their education and enhance occupation opportunities. Funding eligibility and interest rates are affected by aspects such as credit report score, earnings level, debt-to-income proportion, work background, loan quantity, and the specific lender's standards